Development Contribution Plan (DCP)

What is a Development Contribution Plan?

The purpose of a Development Contribution Plan (DCP) is to deliver infrastructure in areas where change is anticipated in population growth and need.

The DCP allows the cost of infrastructure to be apportioned between developers and the community to service the infrastructure needs for that area, such as streetscape improvements, roadworks, footpaths, etc.

Each DCP includes a list of infrastructure projects planned for that area or precinct, which is implemented by the Development Contribution Plan Overlay, a planning tool under the Maroondah Planning Scheme.

If you intend to develop a site within an area covered by the Development Contribution Plan Overlay, a contribution would be required as part of your planning application.

Where are the DCP areas in Maroondah?

A Development Contribution applies if the land is covered by a Development Contribution Plan Overlay, as identified in the Maroondah Planning Scheme.

The overlay can be found at Clause 45.06 of the Maroondah Planning Scheme.

In Maroondah, the following 3 areas are affected by a Development Contribution Plan Overlay:

- Ringwood Metropolitan Activity Centre (RMAC)

- Ringwood Greyfield Precinct (Ringwood GTG)

- Croydon South Precinct (Croydon South GTG)

A Development Contributions Plan was prepared for each of these locations and are incorporated into the Maroondah Planning Scheme.

Ringwood Metropolitan Activity Centre (RMAC)

Development Contribution Overlay Schedule 1 of Clause 45.06 (DCPO1).

Approved as part of Amendment C130 (C137maro and C147maro).

Ringwood Metropolitan Activity Centre Development Contributions Plan

The levy amount for this 2025/26 financial year are as follows:

| Development |

Unit of measurement |

Levies payable by development |

| |

|

Development Infrastructure Levy |

Community Infrastructure Levy |

Total |

| Residential |

Per dwelling |

$7,671.18 |

$0 |

$7,671.18 |

| Retail |

Per square metre of gross floor space |

$222.31 |

- |

$222.31 |

| Commercial |

Per square metre of gross floor space |

$92.63 |

- |

$92.63 |

| Industrial |

Per square metre of gross floor space |

$62.20 |

- |

$62.20 |

Ringwood Greyfield Precinct

Development Contribution Overlay Schedule 1 of Clause 45.06 (DCPO1).

Approved as part of Amendment C130 (C137maro and C147maro).

Ringwood Greyfield Precinct Development Contributions Plan

The levy amount for this 2025/26 financial year are as follows:

| Development |

Unit of measurement |

Levies payable by development |

| |

|

Development Infrastructure Levy |

Community Infrastructure Levy |

Total |

| Residential |

Per dwelling |

$5,624.49 |

$0 |

$5,624.49 |

| Other land uses |

Per square metre of gross floor space |

$46.87 |

- |

$46.87 |

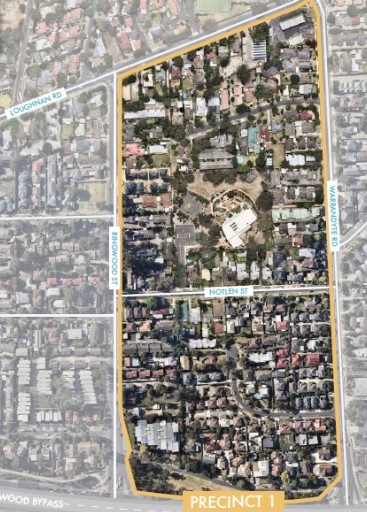

Croydon South Precinct

Development Contribution Overlay Schedule 3 of Clause 45.06 (DCPO3).

Approved as part of Amendment C136 (C136maro and C152maro).

Croydon South Precinct Development Contributions Plan

The levy amount for this 2025/26 financial year are as follows:

| Development |

Unit of measurement |

Levies payable by development |

| |

|

Development Infrastructure Levy |

Community Infrastructure Levy |

Total |

| Residential |

Per dwelling |

$1,789.41 |

$0 |

$1,789.41 |

| Other land uses |

Per square metre of gross floor space |

$14.91 |

- |

$14.91 |

How are contribution rates calculated?

Rates are adjusted on 1 July each year to cover inflation by applying the Producer Price Index for Non Residential Building Construction in Victoria. This index is published by the Australian Bureau of Statistics.

Residential Developments

For residential developments, the rate is based on each dwelling approved, not floor area.

For example if an apartment building contains 25 dwellings, the amount to be paid is 25 x the applicable ‘dwelling’ rate.

Retail, commercial, industrial or other uses

For retail, commercial (i.e. office), industrial or other uses, the rate is based on each square metre of “floorspace”, which:

- includes the total floor area of a building, measured from the outside of external walls or the centre of party walls, and includes all roofed areas,

- minus those areas used for car parking and associated accessways.

Essentially, if the space is contained within walls and a roof, then it would form part of the floor area calculation unless it is used for car parking spaces, driveways or walkways within parking areas. Areas used for storage, services, lobbies, foyers, hallways, stairwells, etc are included in the calculation.

Where these communal areas may be shared between retail and commercial uses within the building, then the total square metre of the communal floor area can be equally split or appropriately apportioned between the respective land use rates.

When do I make payment of the DCP?

A DCP is to be paid at the time specified by the planning permit condition.

A planning permit issued for development or subdivision will include a condition that the payment is to be made prior to the issue of a Building Permit, or if it is a subdivision application it would be prior to the issue of a Statement of Compliance.

An endorsed set of development plans is required so that the calculation of the contribution is accurate and based on the floor area/space approved and to be constructed.

Following endorsement of the plans, the developer/landowner is to provide a calculation of the total gross floor areas for each land use in a development with the total rate for payment in accordance with the rates specified in the DCP. This will be verified by Council’s Statutory Planning team and an invoice issued for payment to be made.

Should you have any queries on the above, please don’t hesitate to contact the Statutory Planning Department on 1300 88 22 33 or 9298 4287.